Why Gold is falling and why it will bounce back, 12/14/2012

Gold has tumbled for two reasons post the alphanumeric extravaganza, QE4. The primary reason is profit booking and the secondary reason is pessimism; pessimism pertaining to US Fiscal Cliff.

“Investors are now focused on the fiscal cliff negotiations, which are looking protracted and threatening to weigh on all markets,” said Xiang Nan, an analyst at CITICS Futures Co., a unit of China’s biggest listed brokerage to Bloomberg.“ We view a drop below $1,700 as a good buying opportunity. The Fed sent a strong signal about supporting the economy and keeping the easy monetary policy stance unchanged, which should support higher gold prices in the longer term.” Nan added.

If the current budget talks between Republicans and Democrats fail, US is sure to go off the cliff and none other than the Congressional Budget Office has predicted contraction in the economy (read recession) even as $600 billion in spending cuts and tax spikes would come into force on its own. The fragile economy that is the United States of America would come to a grinding halt overnight.

And with the worsening Eurozone crisis, things would go out of hand, analysts say. This scenario is deemed best for gold prices, one would think. But it may not be the case.

In fact, there is a haven that is touted safer than gold: US Dollar!

When I say this, I can hear a din of arguments pouring in, that would postulate Dollar having a value lesser than the paper in which it is printed.

But one should also not miss the fact that Dollar appreciated and gold tumbled in the immediate aftermath of the 2008 crisis.

Why this was so?

One of the reasons behind this appreciation in Dollar was the frantic flight to treasuries by investors. And treasuries are dollar denominated. This suddenly pushed up Dollar demand and the result was that investors liquidated their positions in gold and other asset classes and invested in bonds. Not the other way around!

Nobody can rule out a similar occurrence this time around already heralded by flight from gold investments. Well, that also may not be the ultimate case.

Please be sure that this is not the end of the road for gold: it is just the beginning! In 2008, the crisis was not fundamentally about solvency, but about liquidity. But this time around it is the other way around. The crisis is about whether a government would default on its debt. When you feel that you will not get the money back once you have lent it to a person, would you continue to lend? You won't! Debt-ceiling debate is still active an issue in US.

And when QE measures continue unabated, it is just a question of time, a question of 'when' rather than 'will' for Dollar and its losing of value.

The crisis of confidence would lead capital to fly to safe havens. And gold is just what it is: a safe haven.

We are working hard to provide outstanding service to our clients.

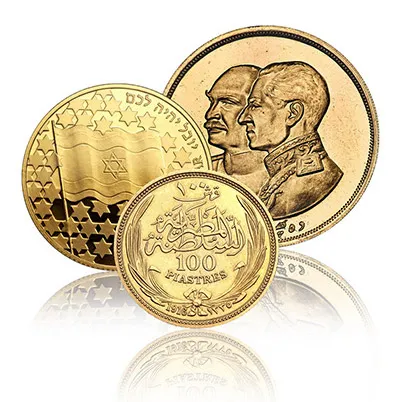

Do not hesitate to contact us for any questions. We will be happy to recommend valuable Gold Coins for your Collection or Investment.

| Follow Us on Facefook |

Daily - News, Tips, Interesting articles, Highlight coins, Clients feedback and review and more and more and more.

Your Like will be very appreciated.